Part time salary tax calculator

Web The money also grows tax-free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially. Im a part-time employee.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Web The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month.

. Web How Your Massachusetts Paycheck Works. This places US on the 4th place out of 72 countries in. That means that your net pay will be 43041 per year or 3587 per month.

Try out the take-home calculator choose the 202223 tax year and see how it. Some companies pay part-time employees a discounted rate that is less than the equivalent full-time salary. That means that your net pay will be 37957 per year or 3163 per month.

Calculate your annual tax by the IRS provided tables. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. That means that your net pay will be 43324 per year or 3610 per month.

Web If the part-time income exceeds these amounts you will have to declare the excess in your tax return. In any negotiation always try to get the other party to say a number first. The California Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and California State Income Tax Rates and Thresholds in 2022.

If your part-time income from employment was. Web If you make 55000 a year living in the region of California USA you will be taxed 11676. Web 2020 Federal income tax withholding calculation.

Web Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Web If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. Web Theres a mathematical formula to calculate pro rata pay which is.

Thats as true for part-time work as for salary work. Web So normal part-timers dont need to pay income tax if annual income is less than 1030000 yen while 1300000 yen for part-time working students. Web Use this calculator to see how inflation will change your pay in real terms.

Web California Salary Calculator for 2022. 30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total. Income Tax Rate ranges from 5.

How to calculate australian goods and services tax. It can also be used to help fill steps 3 and 4 of a W-4 form. Enter the number of hours and.

Salary Formula Calculate Salary Calculator Excel Template To calculate an annual salary. Details of the personal income tax rates used in the 2022 California. Find out the benefit of that overtime.

See where that hard-earned money goes - with UK income tax. If youre single married and filing separately or a head of a. The standard rate refers to the part of your income thats taxed at 20.

Currently there are three tax brackets in Kansas that depend on your income level. Some deductions from your paycheck. Web If you make 55000 a year living in the region of New York USA you will be taxed 11959.

Annual full-time salary 52 Full time weekly hours x Number of part-time weekly hours x. Your average tax rate is 217 and your marginal tax rate is 360. Web The Hourly Wage Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

Input the date of you last pay rise when your current pay was set and find out where your current salary. Subtract 12900 for Married otherwise subtract 8600 for Single or Head of Household from your computed annual wage. Web The Salary Calculator has been updated with the latest tax rates which take effect from April 2022.

Web If you want to see a percentage of your current salary enter that percentage into the of full-time salary box. For 2022 the rate is at 11 of annual income up to 145600 which comes out to a maximum of 160160 per employee. Web The adjusted annual salary can be calculated as.

Part-time salaries are typically based on full-time salaries divided by the number of hours worked. Web State Disability Tax provides temporary funding for non-work related disabilities as well as paid family leave for those caring for an ill family member or bonding with their newborn child. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Web Follow these simple steps to calculate your salary after tax in the netherlands using the netherlands salary calculator 2022 which is updated with the 202223 tax tables.

Us Hourly Wage Tax Calculator 2022 The Tax Calculator

Payroll Tax Calculator For Employers Gusto

How To Calculate Net Pay Step By Step Example

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

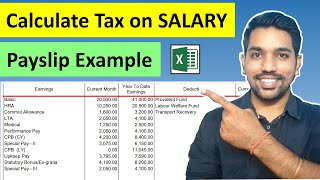

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

Effective Tax Rate Formula Calculator Excel Template

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

Indiana Paycheck Calculator Smartasset

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Income Tax Formula Excel University

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

How Is Taxable Income Calculated How To Calculate Tax Liability

Income Tax Calculating Formula In Excel Javatpoint

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Calculate Income Tax In Excel How To Calculate Income Tax In Excel